iPhone's 8-Year Price Freeze: How Apple Defies Inflation (And Why It Can't Last)

For the past eight years, Apple has managed to keep iPhone prices relatively stable, a remarkable feat considering the global economic landscape. While many products have seen price hikes due to inflation and increased production costs, Apple's flagship device has largely defied this trend. However, recent developments suggest that this era of price stability may be coming to an end.

Apple's ability to maintain consistent iPhone pricing can be attributed to several factors. The company boasts substantial profit margins, allowing it to absorb increased production costs without passing them on to consumers. This approach has not only fostered customer loyalty but also solidified Apple's position in the premium smartphone market. By keeping prices steady, Apple has been able to expand its market share, particularly in the U.S., where it recently hit a record 50% share.

Despite this strategic pricing, external factors are exerting pressure on Apple's cost structure. The recent imposition of a 34% tariff on Chinese goods by the U.S. government has significant implications for Apple, which manufactures a substantial portion of its iPhones in China. Analysts predict that if Apple passes these costs onto consumers, iPhone prices could increase by 30% to 43%. For instance, the base iPhone 16 could see its price rise from $799 to approximately $1,142.

Additionally, the global shortage of semiconductors has led to increased component costs. The U.S. producer price index indicates a steady rise in semiconductor prices since the onset of the COVID-19 pandemic, with expectations of a 20% increase in the coming year. These rising costs further challenge Apple's ability to maintain current pricing levels.

In response to these economic pressures, Apple faces critical decisions regarding its pricing strategy. While the company has historically absorbed additional costs to keep prices stable, the magnitude of current tariffs and component price increases may necessitate adjustments. Analysts suggest that Apple might initially absorb these costs but could implement price hikes with the release of future models, such as the iPhone 17, if the tariffs persist.

Furthermore, Apple's recent introduction of the iPhone 16e at a higher price point than its predecessor indicates a potential shift. The iPhone 16e starts at $599, compared to the iPhone SE's $429, reflecting a move to maintain profit margins while still offering a more affordable option within its lineup.

As Apple navigates these challenges, consumers should be prepared for possible changes in iPhone pricing. While the company has demonstrated resilience in maintaining price stability, the confluence of tariffs, rising component costs, and competitive dynamics may lead to adjustments in the near future. Apple's strategic decisions in the coming months will be pivotal in determining how it balances profitability with consumer expectations in an increasingly complex economic environment.

Recommend for you:

Valve's Strategic Expansion of SteamOS: A New Era in Handheld Gaming

Valve's recent initiative to extend SteamOS to third-party handheld devices marks a pivotal shift in the gaming landscape, potentially redefining market dynamics and challenging established players like Nintendo's upcoming Switch 2.

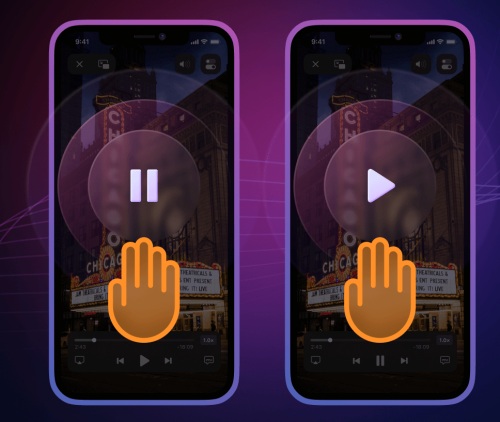

Apple's 'Magic Wand' Patent: Control Devices by Waving Your iPhone

A recently granted patent reveals Apple's exploration into motion-based controls, envisioning a future where users can manipulate electronic devices through gestures made with their iPhones.

OpenAI's Open-Weight Model Initiative and Its Industry Impact

OpenAI, under the leadership of CEO Sam Altman, has recently announced plans to release its first open-weight language model since GPT-2, marking a significant shift in the company's approach to AI development.

Bill Gates Envisions a Future Where AI Makes Jobs Optional

His recent discussions on artificial intelligence (AI) suggest a transformative shift in the workforce, where AI doesn't render jobs obsolete but rather alters the necessity of human labor.